An Extended Goodwin Model with Endogenous Technical Change: Theory and Simulation for the US Economy (1960-2019)

Author

John Cajas Guijarro

Title

An Extended Goodwin Model with Endogenous Technical Change: Theory and Simulation for the US Economy (1960-2019)

Description

Mathematical supplement to accompany Cajas Guijarro (2023): https://mpra.ub.uni-muenchen.de/118878/

Category

Academic Articles & Supplements

Keywords

Extended Goodwin Model, Endogenous Technical Change

URL

http://www.notebookarchive.org/2023-10-cgjt23r/

DOI

https://notebookarchive.org/2023-10-cgjt23r

Date Added

2023-10-27

Date Last Modified

2023-10-27

File Size

1.57 megabytes

Supplements

Rights

CC BY-NC-SA 4.0

Mathematical supplement to accompany Cajas Guijarro (2023): https://mpra.ub.uni-muenchen.de/118878/

An Extended Goodwin Model with Endogenous Technical Change: Theory and Simulation for the US Economy (1960-2019)

An Extended Goodwin Model with Endogenous Technical Change: Theory and Simulation for the US Economy (1960-2019)

John Cajas Guijarro

This notebook extends the two-dimensional Goodwin model of distributive cycles by incorporating endogenous technical change, inspired on some insights originally formulated by Marx. We introduce a three-dimensional dynamical system, expanding the model to include wage share, employment rate, and capital-output ratio as state variables. Theoretical analysis demonstrates an economically meaningful and locally stable equilibrium point, and the Hopf bifurcation theorem reveals the emergence of stable limit cycles as the mechanization-productivity elasticity surpasses a critical value. Econometric estimation of model parameters using ARDL bounds cointegration tests is performed for the US economy from 1965 to 2019. Simulations show damped oscillations, limit cycles, and unstable oscillations, contributing to the understanding of complex capitalist dynamics.

In[]:=

ClearAll["Global`*"]

Parameters estimated for the US economy

In[]:=

simulationUS={δ0.05198494,s0.5626761,β0.01399579,α00.0120001,α10.3334868,ψ00.2678959,ψ10.4210462,γ0.2677537,ρ0.3065009};

The Goodwin Model with a General Capital Accumulation Rate

In[]:=

eq[1]=u[t]w[t]*l[t]/q[t];eq[2]=s(1-u[t])*q[t]k'[t]+δ*k[t];eq[3]=σ[t]k[t]/q[t];eq[4]=k'[t]/k[t]q'[t]/q[t];eq[5]=a[t]q[t]/l[t];eq[6]=a'[t]/a[t]q'[t]/q[t]-l'[t]/l[t];eq[7]=a'[t]/a[t]α;eq[8]=v[t]l[t]/n[t];eq[9]=v'[t]/v[t]l'[t]/l[t]-n'[t]/n[t];eq[10]=n'[t]/n[t]β;eq[11]=(Solve[eq[2],k'[t]][[1,1]]//FullSimplify)/.{RuleEqual};eq[12]=(Solve[{eq[3],eq[4],eq[11]},{q'[t],k'[t],k[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[13]=(Solve[{eq[12],eq[6]},{l'[t],q'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[14]=(Solve[{eq[9],eq[13]},{v'[t],l'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[15]=(Solve[{eq[7],eq[10],eq[14]},{v'[t],a'[t],n'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[17]=w'[t]/w[t]-γ+ρ*v[t];eq[18]=u'[t]/u[t]w'[t]/w[t]+l'[t]/l[t]-q'[t]/q[t];eq[19]=(Solve[{eq[18],eq[6]},{u'[t],q'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[20]=(Solve[{eq[17],eq[19]},{u'[t],w'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[21]=(Solve[{eq[7],eq[20]},{u'[t],a'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};

An Extended Goodwin Model with Endogenous Technical Change

In[]:=

eq[23]=m[t]k[t]/l[t];eq[24]=a'[t]/a[t]α0+α1*(m'[t]/m[t]);eq[25]=σ[t]m[t]/a[t];eq[26]=σ'[t]/σ[t]m'[t]/m[t]-a'[t]/a[t];eq[27]=m'[t]/m[t]-ψ0+ψ1*u[t];eq[28]=(Solve[{eq[24],eq[27]},{a'[t],m'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[29]=(Solve[{eq[26],eq[27],eq[28]},{σ'[t],m'[t],a'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[30]=σ'[t]/σ[t]k'[t]/k[t]-q'[t]/q[t];eq[31]=(Solve[{eq[3],eq[11],eq[30]},{q'[t],k'[t],k[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[32]=(Solve[{eq[6],eq[31]},{l'[t],q'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[33]=(Solve[{eq[9],eq[26],eq[32]},{v'[t],l'[t],σ'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[34]=(Solve[{eq[10],eq[27],eq[33]},{v'[t],m'[t],n'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};eq[35]=(Solve[{eq[17],eq[19],eq[28]},{u'[t],w'[t],a'[t]}][[1,1]]//FullSimplify)/.{RuleEqual};

In[]:=

dynsystem=(Solve[{eq[29],eq[34],eq[35]},{u'[t],v'[t],σ'[t]}][[1]]//FullSimplify)/.{RuleEqual}

Out[]=

[t]-u[t](α0+γ-α1ψ0+α1ψ1u[t]-ρv[t]),[t],[t]-(α0+ψ0-α1ψ0+(-1+α1)ψ1u[t])σ[t]

′

u

′

v

v[t](s-su[t]-(β+δ-ψ0+ψ1u[t])σ[t])

σ[t]

′

σ

In[]:=

dyneq=(Solve[dynsystem/.{u'[t]0,v'[t]0,σ'[t]0},{u[t],v[t],σ[t]}][[1]]//FullSimplify)/.{RuleEqual}

Out[]=

u[t],v[t],σ[t]-

-+ψ0

α0

-1+α1

ψ1

-+γ

α0

-1+α1

ρ

s(α0+ψ0-α1ψ0+(-1+α1)ψ1)

(α0-(-1+α1)(β+δ))ψ1

In[]:=

ZZ=Solve[{Z11-α1,Z2α0+(1-α1)ψ0,Z3γ(1-α1)+α0,Z4ψ1((1-α1)(β+δ)+α0),Z5s((1-α1)(ψ1-ψ0)-α0)},{α1,β,γ,α0,s}][[1]]//FullSimplify

Out[]=

α11-Z1,β-δ+ψ0+,γ,α0Z2-Z1ψ0,s

Z4-Z2ψ1

Z1ψ1

-Z2+Z3+Z1ψ0

Z1

Z5

-Z2+Z1ψ1

In[]:=

ZZR=Solve[{Z11-α1,Z2α0+(1-α1)ψ0,Z3γ(1-α1)+α0,Z4ψ1((1-α1)(β+δ)+α0),Z5s((1-α1)(ψ1-ψ0)-α0)},{Z1,Z2,Z3,Z4,Z5}][[1]]//FullSimplify

Out[]=

{Z11-α1,Z2α0+ψ0-α1ψ0,Z3α0+γ-α1γ,Z4(α0-(-1+α1)(β+δ))ψ1,Z5-sα0+s(-1+α1)(ψ0-ψ1)}

In[]:=

(dyneq/.ZZ)//FullSimplify

Out[]=

u[t],v[t],σ[t]

Z2

Z1ψ1

Z3

Z1ρ

Z5

Z4

Dynamic Analysis of the Extended Model

In[]:=

jacobian=D[{dynsystem[[1,2]],dynsystem[[2,2]],dynsystem[[3,2]]},{{u[t],v[t],σ[t]}}]//FullSimplify

Out[]=

{-α0-γ+α1ψ0-2α1ψ1u[t]+ρv[t],ρu[t],0},-,,,{-(-1+α1)ψ1σ[t],0,-α0+(-1+α1)ψ0+(ψ1-α1ψ1)u[t]}

v[t](s+ψ1σ[t])

σ[t]

s-su[t]-(β+δ-ψ0+ψ1u[t])σ[t]

σ[t]

s(-1+u[t])v[t]

2

σ[t]

In[]:=

jacobianeq=(jacobian/.(dyneq/.{EqualRule}))//FullSimplify

Out[]=

-α1ψ0,,0,,0,,,0,0

α0α1

-1+α1

ρ-+ψ0

α0

-1+α1

ψ1

(α0+γ-α1γ)ψ1(β+δ-ψ0+ψ1)

ρ(α0+ψ0-α1ψ0+(-1+α1)ψ1)

(α0+γ-α1γ)ψ1

2

(α0-(-1+α1)(β+δ))

sρ(α0+ψ0-α1ψ0+(-1+α1)ψ1)

2

(-1+α1)

s(-1+α1)(α0+ψ0-α1ψ0+(-1+α1)ψ1)

α0-(-1+α1)(β+δ)

In[]:=

jacobianeq//MatrixForm

Out[]//MatrixForm=

α0α1 -1+α1 | ρ- α0 -1+α1 ψ1 | 0 |

(α0+γ-α1γ)ψ1(β+δ-ψ0+ψ1) ρ(α0+ψ0-α1ψ0+(-1+α1)ψ1) | 0 | (α0+γ-α1γ) 2 (α0-(-1+α1)(β+δ)) s 2 (-1+α1) |

s(-1+α1)(α0+ψ0-α1ψ0+(-1+α1)ψ1) α0-(-1+α1)(β+δ) | 0 | 0 |

In[]:=

jacobianeqZZ=((jacobianeq/.ZZ)//FullSimplify)

Out[]=

,,0,,0,-Z5ρψ1,,0,0

(-1+Z1)Z2

Z1

Z2ρ

Z1ψ1

Z3(Z4+ψ1(-Z2+Z1ψ1))

Z1ρ(Z2-Z1ψ1)

Z3

2

Z4

2

Z1

Z1Z5ψ1

Z4

In[]:=

jacobianeqZZ//MatrixForm

Out[]//MatrixForm=

(-1+Z1)Z2 Z1 | Z2ρ Z1ψ1 | 0 |

Z3(Z4+ψ1(-Z2+Z1ψ1)) Z1ρ(Z2-Z1ψ1) | 0 | - Z3 2 Z4 2 Z1 |

Z1Z5ψ1 Z4 | 0 | 0 |

In[]:=

ecb1=b1(-Tr[jacobianeq]//FullSimplify)

Out[]=

b1α1-+ψ0

α0

-1+α1

In[]:=

ecb1ZZ=b1((ecb1[[2]]/.ZZ)//FullSimplify)

Out[]=

b1-1+Z2

1

Z1

In[]:=

ecb2=b2(Tr[Minors[jacobianeq]]//FullSimplify)

Out[]=

b2-

(α0+γ-α1γ)-+ψ0(β+δ-ψ0+ψ1)

α0

-1+α1

α0+ψ0-α1ψ0+(-1+α1)ψ1

In[]:=

ecb2ZZ=b2Collect[((ecb2[[2]]/.ZZ[[1;;5]])//FullSimplify),ϕ]

Out[]=

b2

Z2Z31+

Z4

ψ1(-Z2+Z1ψ1)

2

Z1

In[]:=

(*Manualverificationofb2*)(((Z2(Z3Z4(sZ4+ψ1Z5))/(ψ1Z1^2Z4Z5))/.ZZR)-ecb2[[2]])//FullSimplify

Out[]=

0

In[]:=

ecb3=b3(-Det[jacobianeq]//FullSimplify)

Out[]=

b3

(α0+γ-α1γ)(α0-(-1+α1)(β+δ))(α0+ψ0-α1ψ0)

2

(-1+α1)

In[]:=

ecb3ZZ=b3((ecb3[[2]]/.ZZ)//FullSimplify)

Out[]=

b3ψ1

Z2Z3Z4

2

Z1

In[]:=

ecb123=b1*b2-b3((ecb1[[2]]*ecb2[[2]]-ecb3[[2]])//FullSimplify)

Out[]=

b1b2-b3(α0+γ-α1γ)--

(α0-(-1+α1)(β+δ))(α0+ψ0-α1ψ0)

2

(-1+α1)

α1(β+δ-ψ0+ψ1)

2

-+ψ0

α0

-1+α1

α0+ψ0-α1ψ0+(-1+α1)ψ1

In[]:=

{ecb1,ecb2,ecb3,ecb123}/.simulationUS

Out[]=

{b10.0953439,b20.132469,b30.00457323,b1b2-b30.00805686}

In[]:=

ecb123ZZ=b1*b2-b3((ecb123[[2]]/.ZZ)//FullSimplify)

Out[]=

b1b2-b3ψ1(-Z2+Z1ψ1)

Z2Z3((-1+Z1)ψ1-Z4ψ1+Z2(Z4-(-1+Z1)Z1))

2

Z2

2

Z1

2

ψ1

3

Z1

In[]:=

ecb123null=Solve[ecb123[[2]]0,α1]//FullSimplify

Out[]=

α1,α1,α1ψ0(2α0+β+δ+ψ0)-(2(α0+β+δ)+ψ0)ψ1+ψ0(2α0+β+δ+ψ0)-(2(α0+β+δ)+ψ0)ψ1-

α0+γ

γ

α0+ψ0

ψ0

1

2-2(β+δ+ψ0)ψ1

2

ψ0

β+δ-ψ0+ψ1

(β+δ-ψ0)+(4α0(α0+β+δ)+)ψ1

,α12

ψ0

2

ψ0

1

2-2(β+δ+ψ0)ψ1

2

ψ0

β+δ-ψ0+ψ1

(β+δ-ψ0)+(4α0(α0+β+δ)+)ψ1

2

ψ0

2

ψ0

In[]:=

(*Wechoosethethirdroot*)ecb123null/.simulationUS

Out[]=

{{0.3334871.04482},{0.3334871.04479},{0.3334870.1527},{0.3334871.04757}}

In[]:=

paramHB=α1c(ecb123null[[3,1,2]]//FullSimplify)

Out[]=

α1cψ0(2α0+β+δ+ψ0)-(2(α0+β+δ)+ψ0)ψ1+

1

2-2(β+δ+ψ0)ψ1

2

ψ0

β+δ-ψ0+ψ1

(β+δ-ψ0)+(4α0(α0+β+δ)+)ψ1

2

ψ0

2

ψ0

In[]:=

(*Manualverificationofα1c*)Z6=(α0+β+δ)ψ1+(α0+β+δ+ψ0)(ψ1-ψ0)-α0ψ0;Z7=(β+δ+ψ1-ψ0)((β+δ+ψ1-ψ0)ψ0^2+4α0ψ1(α0+β+δ));Z8=(β+δ)ψ1+ψ0(ψ1-ψ0);solα1=α1c((Z6-Z7^(1/2))/(2Z8))(paramHB[[2]]-solα1[[2]])/.simulationUS

Out[]=

α1c-α0ψ0+(α0+β+δ)ψ1+(α0+β+δ+ψ0)(-ψ0+ψ1)-

(β+δ-ψ0+ψ1)(4α0(α0+β+δ)ψ1+(β+δ-ψ0+ψ1))

(2((β+δ)ψ1+ψ0(-ψ0+ψ1)))2

ψ0

Out[]=

2.77556×

-17

10

In[]:=

dydα1=D[ecb123[[2]],α1]//FullSimplify(dydα1/.{α1paramHB[[2]]})/.simulationUS

Out[]=

γ(α0-(-1+α1)(β+δ))(α0+ψ0-α1ψ0)

2

(-1+α1)

α1γ(β+δ-ψ0+ψ1)

2

-+ψ0

α0

-1+α1

α0+ψ0-α1ψ0+(-1+α1)ψ1

(α0-(-1+α1)(β+δ))ψ0

2

(-1+α1)

(β+δ)(α0+ψ0-α1ψ0)

2

(-1+α1)

2(α0-(-1+α1)(β+δ))(α0+ψ0-α1ψ0)

3

(-1+α1)

α1(-ψ0+ψ1)(β+δ-ψ0+ψ1)

2

-+ψ0

α0

-1+α1

2

(α0+ψ0-α1ψ0+(-1+α1)ψ1)

2

-+ψ0

α0

-1+α1

α0+ψ0-α1ψ0+(-1+α1)ψ1

2α0α1(α0+ψ0-α1ψ0)(β+δ-ψ0+ψ1)

3

(-1+α1)

Out[]=

0.0415772

Simulating the Extended Goodwin Model for the US Economy

In[]:=

(*Estimatedequilibrium*)dyneqUS=dyneq/.simulationUS

Out[]=

{u[t]0.679023,v[t]0.932324,σ[t]2.15045}

In[]:=

ZZR/.simulationUS

Out[]=

{Z10.666513,Z20.190556,Z30.190461,Z40.023569,Z50.0506839}

In[]:=

{Z6,Z7,Z8}/.simulationUS

Out[]=

{0.0825899,0.00379155,0.0688093}

(*Stabilityconditions*)

In[]:=

{0<α0<1,paramHB[[2]]<α1<1,ψ0<ψ1,α0<(1-α1)(ψ1-ψ0)}/.simulationUS

Out[]=

{True,True,True,True}

In[]:=

paramHB/.simulationUS

Out[]=

α1c0.1527

(*USdata:wageshareu*)

In[]:=

dataUSu={0.68163977429261`,0.6762079686932578`,0.6703020187888448`,0.6672112079658565`,0.6637166837270754`,0.6551652655601355`,0.6540088798912439`,0.6624361375639994`,0.6667170912992468`,0.6786538315462496`,0.6872798811799025`,0.6768584519584151`,0.6747308610033602`,0.6711950252797722`,0.6769697061039261`,0.6622405996129658`,0.6557701637474288`,0.6547657963622824`,0.6518295348257737`,0.6524805477480169`,0.6611751201971099`,0.6531424787125644`,0.6614561642360852`,0.6474789638475258`,0.6405654088484588`,0.6402262537412091`,0.6446686006904069`,0.6515306293740686`,0.6548645509206995`,0.6469221146649571`,0.6516900617840478`,0.6559207015052103`,0.6562631796482513`,0.6500498808399241`,0.6429132529781422`,0.6402874484434816`,0.6362012734420653`,0.6371885470875576`,0.6471446668881708`,0.6461861791886708`,0.656133893474094`,0.6550992427393026`,0.6458015541522647`,0.6398076159505142`,0.6355251510171781`,0.6260167549115426`,0.6257361125400861`,0.6274695847761869`,0.6274878326745569`,0.6166215991573578`,0.6055576917548396`,0.604905663258957`,0.6038348356847936`,0.6003008360365397`,0.6025444916173803`,0.6086108325907355`,0.6088389974256897`,0.6106143857603832`,0.6095261014040809`,0.6105119147514427`};

(*USdata:employmentratev*)

In[]:=

dataUSv={0.9500438922858623`,0.9390440921094333`,0.9500795783011609`,0.9475348278448863`,0.9522694931492633`,0.9588684157082397`,0.9657805564671591`,0.9658792221741144`,0.9677726015726336`,0.9686573146647224`,0.9557590714197094`,0.9464285601197217`,0.9488737507995864`,0.955182333972687`,0.9486598495815116`,0.9218222745633425`,0.9290841260576144`,0.9345362937509049`,0.9437204277625205`,0.9464446225216421`,0.934374808465304`,0.9297567762328705`,0.9102749732419412`,0.9111955646982628`,0.9306971972336341`,0.9336784183317703`,0.9355999749717907`,0.9429481737522166`,0.9492666309776345`,0.9514866629395725`,0.948336726684943`,0.9369104577321784`,0.9305489138443996`,0.9358688140494529`,0.943395332820968`,0.9480561647279049`,0.9498170430365321`,0.9540492150158328`,0.9580728357886493`,0.9608915138575733`,0.9628343083994986`,0.9557819590913228`,0.9456612682496546`,0.9432265244849364`,0.9475709166243108`,0.9515880102040817`,0.955897267911026`,0.9557881981098486`,0.9444205701188941`,0.9106606474951712`,0.9068909771272167`,0.9137847560180214`,0.9222866574363844`,0.9292477409508381`,0.9409066664044776`,0.9495476418814839`,0.9533325305557228`,0.9582301645177443`,0.9626831224449148`,0.9648807586870463`};

(*USdata:capital/outputratiosigmaσ*)

In[]:=

dataUSs={3.260911137629554`,3.254930972075523`,3.146045466649613`,3.100644627336144`,3.019220530160392`,2.92333055189236`,2.821961574882685`,2.837466443866576`,2.797110607773657`,2.800255309246566`,2.877467022240052`,2.862512258137597`,2.789192293054545`,2.720296417704668`,2.805461630650369`,2.861047940521664`,2.767238011757639`,2.707796479468761`,2.631926152765534`,2.622036332443594`,2.700016552879566`,2.706963656661053`,2.800988423354921`,2.732056442146635`,2.619976755573849`,2.5898846202387`,2.574209370568309`,2.557260041107037`,2.520847364815606`,2.494142446044449`,2.507068480589243`,2.562973683593347`,2.522234867594404`,2.501491563464673`,2.466157408343646`,2.454625656293911`,2.427332388390513`,2.392154654671856`,2.363679941574662`,2.334589788138811`,2.323762053245685`,2.371516757680217`,2.401822932631213`,2.404990925244657`,2.392627320994428`,2.392081723913996`,2.406604395688412`,2.426136397804594`,2.475860092616186`,2.56530800727826`,2.52333456173537`,2.515255098503582`,2.49663241700221`,2.494071561016768`,2.484840680499102`,2.465863076111207`,2.472800286315461`,2.469508606426756`,2.455340481354787`,2.453816908435104`};

(*Identifyinginitialconditions*)

In[]:=

distance=List[];

In[]:=

Do[initialcondS1={u[1]dataUSu[[i]],v[1]dataUSv[[i]],σ[1]dataUSs[[i]]};S1=NDSolve[Join[dynsystem,initialcondS1]/.simulationUS,{u,v,σ},{t,1,60}];AppendTo[distance,Mean[Table[((dataUSu[[x]]-S1[[1,1,2]][x])^2+(dataUSv[[x]]-S1[[1,2,2]][x])^2+(dataUSs[[x]]-S1[[1,3,2]][x])^2)^0.5,{x,1,60}]]];,{i,1,60}]

In[]:=

min=Position[distance,Min[distance]][[1,1]]

Out[]=

3

(*SimulationfortheUSeconomy*)

In[]:=

initialcondS1={u[1]dataUSu[[min]],v[1]dataUSv[[min]],σ[1]dataUSs[[min]]}

Out[]=

{u[1]0.670302,v[1]0.95008,σ[1]3.14605}

In[]:=

S1=NDSolve[Join[dynsystem,initialcondS1]/.simulationUS,{u,v,σ},{t,1,1000}];

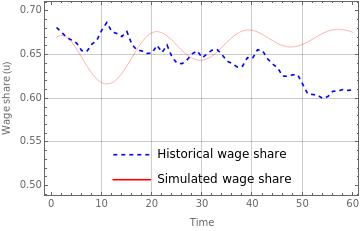

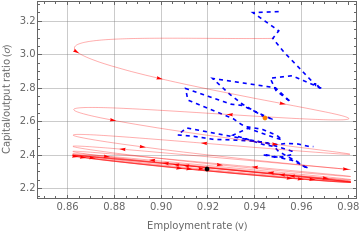

(*Figure1*)

In[]:=

fig1a=Legended[Show[ListLinePlot[dataUSu,PlotStyle{Dashed,Blue}],Plot[S1[[1,1,2]][t],{t,1,60},PlotStyle{Red,Thickness[0.001]}],PlotRange{0.5,0.7},AxesOrigin{0,0.5},FrameLabel{"Time","Wage share (u)"},FrameTrue,GridLinesAutomatic],Placed[LineLegend[{{Dashed,Blue},Red},{"Historical wage share","Simulated wage share"}],{0.5,0.15}]]

Out[]=

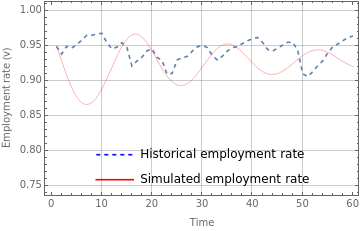

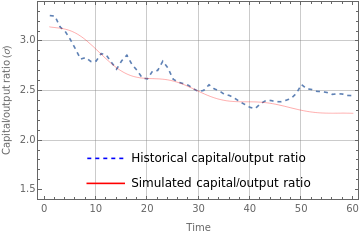

In[]:=

fig1b=Legended[Show[ListLinePlot[dataUSv,PlotStyleDashed],Plot[S1[[1,2,2]][t],{t,1,60},PlotStyle{Red,Thickness[0.001]}],PlotRange{0.75,1},AxesOrigin{0,0.75},FrameLabel{"Time","Employment rate (v)"},FrameTrue,GridLinesAutomatic],Placed[LineLegend[{{Dashed,Blue},Red},{"Historical employment rate","Simulated employment rate"}],{0.5,0.15}]]

Out[]=

In[]:=

fig1c=Legended[Show[ListLinePlot[dataUSs,PlotStyleDashed],Plot[S1[[1,3,2]][t],{t,1,60},PlotStyle{Red,Thickness[0.001]}],PlotRange{1.5,3.3},AxesOrigin{0,1.5},FrameLabel{"Time","Capital/output ratio (σ)"},FrameTrue,GridLinesAutomatic],Placed[LineLegend[{{Dashed,Blue},Red},{"Historical capital/output ratio","Simulated capital/output ratio"}],{0.5,0.15}]]

Out[]=

In[]:=

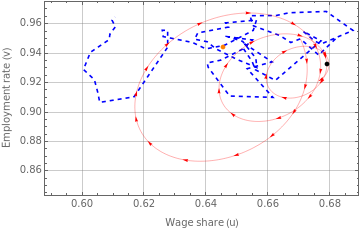

(*Figure2*)

In[]:=

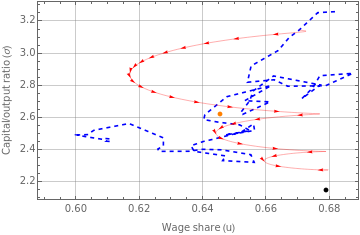

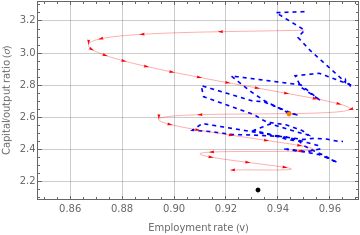

fig2a=Legended[Show[ListLinePlot[Transpose@{dataUSu,dataUSv},PlotStyle{Blue,Dashed}],ParametricPlot[{S1[[1,1,2]][t],S1[[1,2,2]][t]},{t,1,60},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.018,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqUS[[1,2]],dyneqUS[[2,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[2,2]]}]}],PlotRangeAll,AxesOrigin{0.59,0.85},FrameLabel{"Wage share (u)","Employment rate (v)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

In[]:=

fig2b=Legended[Show[ListLinePlot[Transpose@{dataUSu,dataUSs},PlotStyle{Blue,Dashed}],ParametricPlot[{S1[[1,1,2]][t],S1[[1,3,2]][t]},{t,1,60},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.018,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqUS[[1,2]],dyneqUS[[3,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesOrigin{0.59,2.2},FrameLabel{"Wage share (u)","Capital/output ratio (σ)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

In[]:=

fig2c=Legended[Show[ListLinePlot[Transpose@{dataUSv,dataUSs},PlotStyle{Blue,Dashed}],ParametricPlot[{S1[[1,2,2]][t],S1[[1,3,2]][t]},{t,1,60},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.017,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqUS[[2,2]],dyneqUS[[3,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[2,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesOrigin{0.85,2.2},FrameLabel{"Employment rate (v)","Capital/output ratio (σ)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

(*Figure3*)

In[]:=

fig3=Legended[Show[ListPointPlot3D[Transpose@{dataUSu,dataUSv,dataUSs},PlotStyle{Blue,PointSize[0.013]}],ParametricPlot3D[{S1[[1,1,2]][t],S1[[1,2,2]][t],S1[[1,3,2]][t]},{t,1,60},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.003,8]}]],Arrow[x]},Graphics3D[{PointSize[0.015],Black,Point[{dyneqUS[[1,2]],dyneqUS[[2,2]],dyneqUS[[3,2]]}]}],Graphics3D[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[2,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesStyleGrayLevel[0.5],BoxStyleGrayLevel[0.8],AxesLabel{"u","v","σ"}],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical data","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

In[]:=

(*Historicalmean*)averageUS={u[t]Mean[dataUSu],v[t]Mean[dataUSv],σ[t]Mean[dataUSs]}

Out[]=

{u[t]0.64545,v[t]0.944448,σ[t]2.62379}

(*Relativedifferencebewteenhistoricalmeanandequilibrium*)Table[(dyneqUS[[x,2]]/averageUS[[x,2]]-1)*100,{x,1,3}]

Out[]=

{5.20154,-1.28378,-18.0403}

(*MSEasaproportionofthehistoricalmean*)

In[]:=

{((Mean[Table[(dataUSu[[x]]-S1[[1,1,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSu]*100,((Mean[Table[(dataUSv[[x]]-S1[[1,2,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSv]*100,((Mean[Table[(dataUSs[[x]]-S1[[1,3,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSs]*100}

Out[]=

{5.93433,4.13404,4.6355}

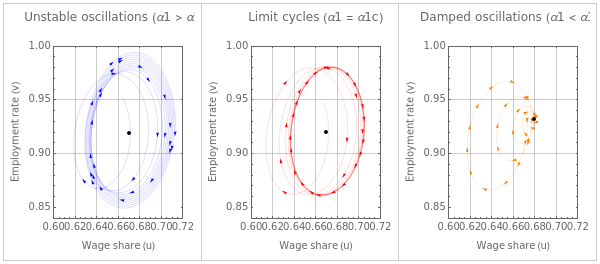

Limit Cycles and the Mechanization-Productivity Relationship

(*Simulationoflimitcycles*)

In[]:=

simulationLC=simulationUS;simulationLC[[5]]=α1(paramHB[[2]]/.simulationUS);simulationLC

Out[]=

{δ0.0519849,s0.562676,β0.0139958,α00.0120001,α10.1527,ψ00.267896,ψ10.421046,γ0.267754,ρ0.306501}

(*DynamicequilibriumLC*)

In[]:=

dyneqLC=dyneq/.simulationLC

Out[]=

{u[t]0.6699,v[t]0.91979,σ[t]2.31759}

(*Identifyinginitialconditions*)

In[]:=

distance=List[];

In[]:=

Do[initialcondS2={u[1]dataUSu[[i]],v[1]dataUSv[[i]],σ[1]dataUSs[[i]]};S2=NDSolve[Join[dynsystem,initialcondS2]/.simulationLC,{u,v,σ},{t,1,60}];AppendTo[distance,Mean[Table[((dataUSu[[x]]-S2[[1,1,2]][x])^2+(dataUSv[[x]]-S2[[1,2,2]][x])^2+(dataUSs[[x]]-S2[[1,3,2]][x])^2)^0.5,{x,1,60}]]];,{i,1,60}]

In[]:=

min=Position[distance,Min[distance]][[1,1]]

Out[]=

4

In[]:=

initialcondS2={u[1]dataUSu[[min]],v[1]dataUSv[[min]],σ[1]dataUSs[[min]]}

Out[]=

{u[1]0.667211,v[1]0.947535,σ[1]3.10064}

In[]:=

S2=NDSolve[Join[dynsystem,initialcondS2]/.simulationLC,{u,v,σ},{t,1,1000}]

Out[]=

uInterpolatingFunction

,vInterpolatingFunction

,σInterpolatingFunction

|

|

|

(*Figure4*)

In[]:=

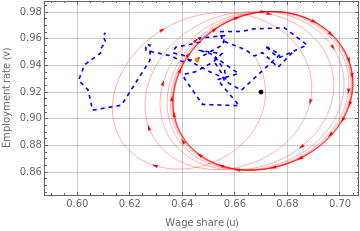

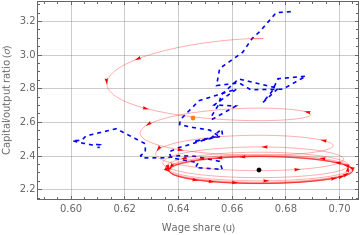

fig4a=Legended[Show[ListLinePlot[Transpose@{dataUSu,dataUSv},PlotStyle{Blue,Dashed}],ParametricPlot[{S2[[1,1,2]][t],S2[[1,2,2]][t]},{t,1,200},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.02,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqLC[[1,2]],dyneqLC[[2,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[2,2]]}]}],PlotRangeAll,AxesOrigin{0.59,0.85},FrameLabel{"Wage share (u)","Employment rate (v)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

In[]:=

fig4b=Legended[Show[ListLinePlot[Transpose@{dataUSu,dataUSs},PlotStyle{Blue,Dashed}],ParametricPlot[{S2[[1,1,2]][t],S2[[1,3,2]][t]},{t,1,200},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.02,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqLC[[1,2]],dyneqLC[[3,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesOrigin{0.59,2.2},FrameLabel{"Wage share (u)","Capital/output ratio (σ)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

In[]:=

fig4c=Legended[Show[ListLinePlot[Transpose@{dataUSv,dataUSs},PlotStyle{Blue,Dashed}],ParametricPlot[{S2[[1,2,2]][t],S2[[1,3,2]][t]},{t,1,200},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.02,30]}]],Arrow[x]},Graphics[{PointSize[0.015],Black,Point[{dyneqLC[[2,2]],dyneqLC[[3,2]]}]}],Graphics[{PointSize[0.015],Orange,Point[{averageUS[[2,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesOrigin{0.85,2.2},FrameLabel{"Employment rate (v)","Capital/output ratio (σ)"},FrameTrue,GridLinesAutomatic],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical trajectory","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

|

(*Figure5*)

In[]:=

fig5=Legended[Show[ListPointPlot3D[Transpose@{dataUSu,dataUSv,dataUSs},PlotStyle{Blue,PointSize[0.013]}],ParametricPlot3D[{S2[[1,1,2]][t],S2[[1,2,2]][t],S2[[1,3,2]][t]},{t,1,200},PlotStyle{Red,Thickness[0.001]}]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.005,15]}]],Arrow[x]},Graphics3D[{PointSize[0.015],Black,Point[{dyneqLC[[1,2]],dyneqLC[[2,2]],dyneqLC[[3,2]]}]}],Graphics3D[{PointSize[0.015],Orange,Point[{averageUS[[1,2]],averageUS[[2,2]],averageUS[[3,2]]}]}],PlotRangeAll,AxesStyleGrayLevel[0.5],BoxStyleGrayLevel[0.8],AxesLabel{"u","v","σ"}],LineLegend[{{Dashed,Blue},Orange,Red,Black},{"Historical data","Historical average","Simulated trajectory","Simulated equilibrium"}]]

Out[]=

|

In[]:=

(*Relativedifferencebewteenhistoricalmeanandequilibrium*)Table[(dyneqLC[[x,2]]/averageUS[[x,2]]-1)*100,{x,1,3}]

Out[]=

{3.78798,-2.61086,-11.6703}

(*MSEasaproportionofthehistoricalmean*)

In[]:=

{((Mean[Table[(dataUSu[[x]]-S2[[1,1,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSu]*100,((Mean[Table[(dataUSv[[x]]-S2[[1,2,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSv]*100,((Mean[Table[(dataUSs[[x]]-S2[[1,3,2]][x])^2,{x,1,60}]])^0.5)/Mean[dataUSs]*100}

Out[]=

{6.63071,5.82881,4.31434}

(*Simulationofunstableoscillations*)

In[]:=

simulationUO=simulationUS;simulationUO[[5]]=α1(paramHB[[2]]/.simulationUS)-0.01;simulationUO

Out[]=

{δ0.0519849,s0.562676,β0.0139958,α00.0120001,α10.1427,ψ00.267896,ψ10.421046,γ0.267754,ρ0.306501}

(*DynamicequilibriumUO*)

In[]:=

dyneqUO=dyneq/.simulationUO

Out[]=

{u[t]0.669507,v[t]0.919251,σ[t]2.32514}

(*Identifyinginitialconditions*)

In[]:=

distance=List[];

In[]:=

Do[initialcondS3={u[1]dataUSu[[i]],v[1]dataUSv[[i]],σ[1]dataUSs[[i]]};S3=NDSolve[Join[dynsystem,initialcondS3]/.simulationUO,{u,v,σ},{t,1,60}];AppendTo[distance,Mean[Table[((dataUSu[[x]]-S3[[1,1,2]][x])^2+(dataUSv[[x]]-S3[[1,2,2]][x])^2+(dataUSs[[x]]-S3[[1,3,2]][x])^2)^0.5,{x,1,60}]]];,{i,1,60}]

In[]:=

min=Position[distance,Min[distance]][[1,1]]

Out[]=

5

In[]:=

initialcondS3={u[1]dataUSu[[min]],v[1]dataUSv[[min]],σ[1]dataUSs[[min]]}

Out[]=

{u[1]0.663717,v[1]0.952269,σ[1]3.01922}

In[]:=

S3=NDSolve[Join[dynsystem,initialcondS3]/.simulationUO,{u,v,σ},{t,1,1000}]

Out[]=

uInterpolatingFunction

,vInterpolatingFunction

,σInterpolatingFunction

|

|

|

(*Figure6*)

In[]:=

fig6=Show[GraphicsGrid[{{Show[ParametricPlot[{S3[[1,1,2]][t],S3[[1,2,2]][t]},{t,1,200},PlotStyle{Blue,Thickness[0.001]},PlotRange{{0.60,0.72},{0.84,1}},FrameLabel{"Wage share (u)","Employment rate (v)"},FrameTrue,GridLinesAutomatic,PlotLabel"Unstable oscillations (α1 > α1c)"]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.04,30]}]],Arrow[x]},Graphics[{PointSize[0.03],Black,Point[{dyneqUO[[1,2]],dyneqUO[[2,2]]}]}]],Show[ParametricPlot[{S2[[1,1,2]][t],S2[[1,2,2]][t]},{t,1,200},PlotStyle{Red,Thickness[0.001]},PlotRange{{0.60,0.72},{0.84,1}},FrameLabel{"Wage share (u)","Employment rate (v)"},FrameTrue,GridLinesAutomatic,PlotLabel"Limit cycles (α1 = α1c)"]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.04,30]}]],Arrow[x]},Graphics[{PointSize[0.03],Black,Point[{dyneqLC[[1,2]],dyneqLC[[2,2]]}]}]],Show[ParametricPlot[{S1[[1,1,2]][t],S1[[1,2,2]][t]},{t,1,200},PlotStyle{Orange,Thickness[0.001]},PlotRange{{0.60,0.72},{0.84,1}},FrameLabel{"Wage share (u)","Employment rate (v)"},FrameTrue,GridLinesAutomatic,PlotLabel"Damped oscillations (α1 < α1c)"]/.Line[x_]{Arrowheads[Flatten[{0,ConstantArray[0.04,30]}]],Arrow[x]},Graphics[{PointSize[0.03],Black,Point[{dyneqUS[[1,2]],dyneqUS[[2,2]]}]}]]}},FrameAll,FrameStyleGrayLevel[0.8]]]

Out[]=

Cite this as: John Cajas Guijarro, "An Extended Goodwin Model with Endogenous Technical Change: Theory and Simulation for the US Economy (1960-2019)" from the Notebook Archive (2023), https://notebookarchive.org/2023-10-cgjt23r

Download